tax avoidance vs tax evasion south africa

Staff Writer 14 September 2021. Undoubtedly skewed by this reality.

Guest Blog Tax Avoidance And Evasion In Africa Tax Justice Network

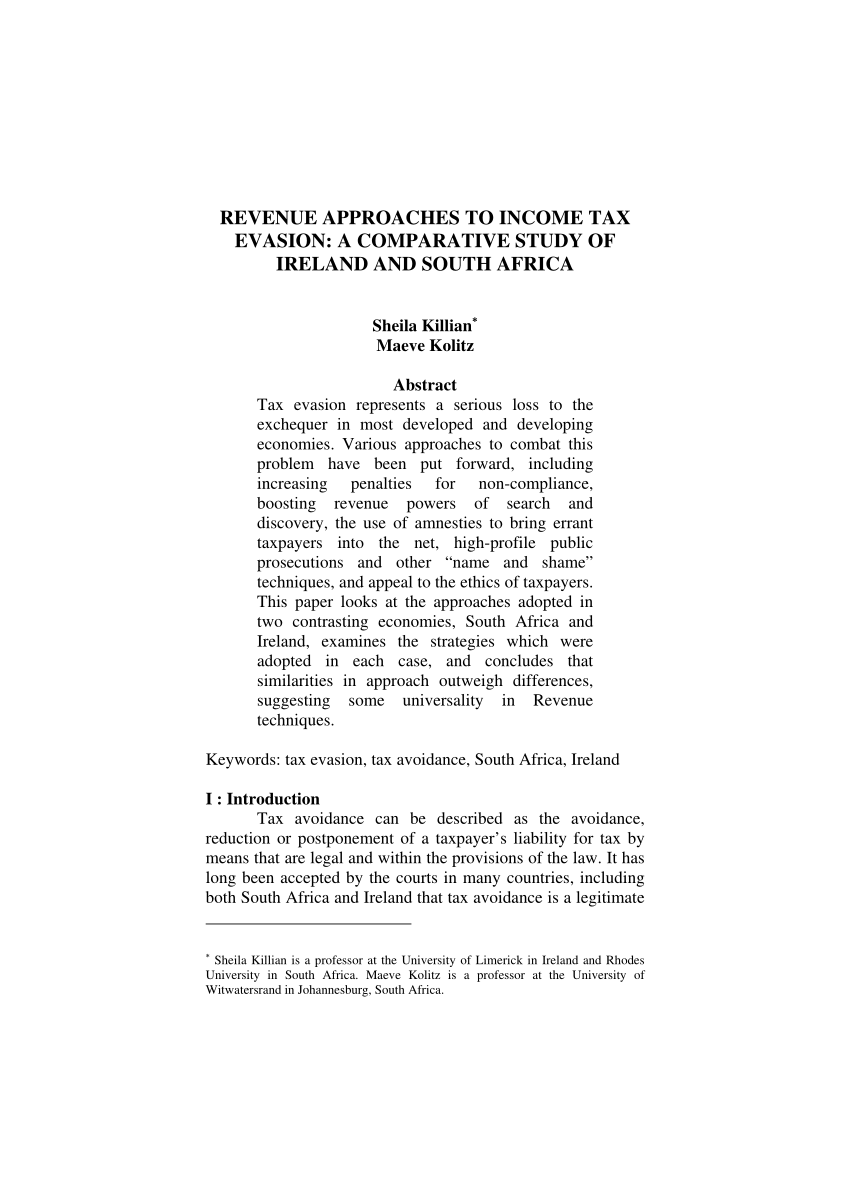

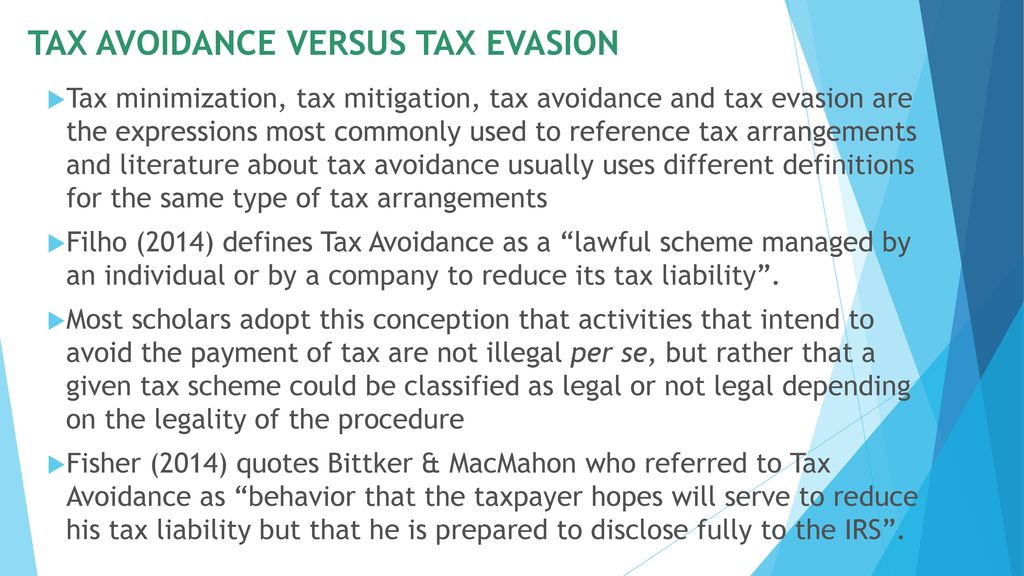

Tax avoidance is the legitimate minimizing of taxes using methods included in the tax code.

. Tax avoidance may be considered as either the amoral dodging of ones duties to society part of a strategy of not supporting violent government activities or just the right of. Financial decisions are wrapped up in thorny social issues and a broken justice. In tax avoidance you structure your affairs to.

Paying corporate tax in South Africa in 2020 is not for the faint of heart. For someone to be found guilty of tax evasion there must have been an. There is not so much of a fine line between tax evasion.

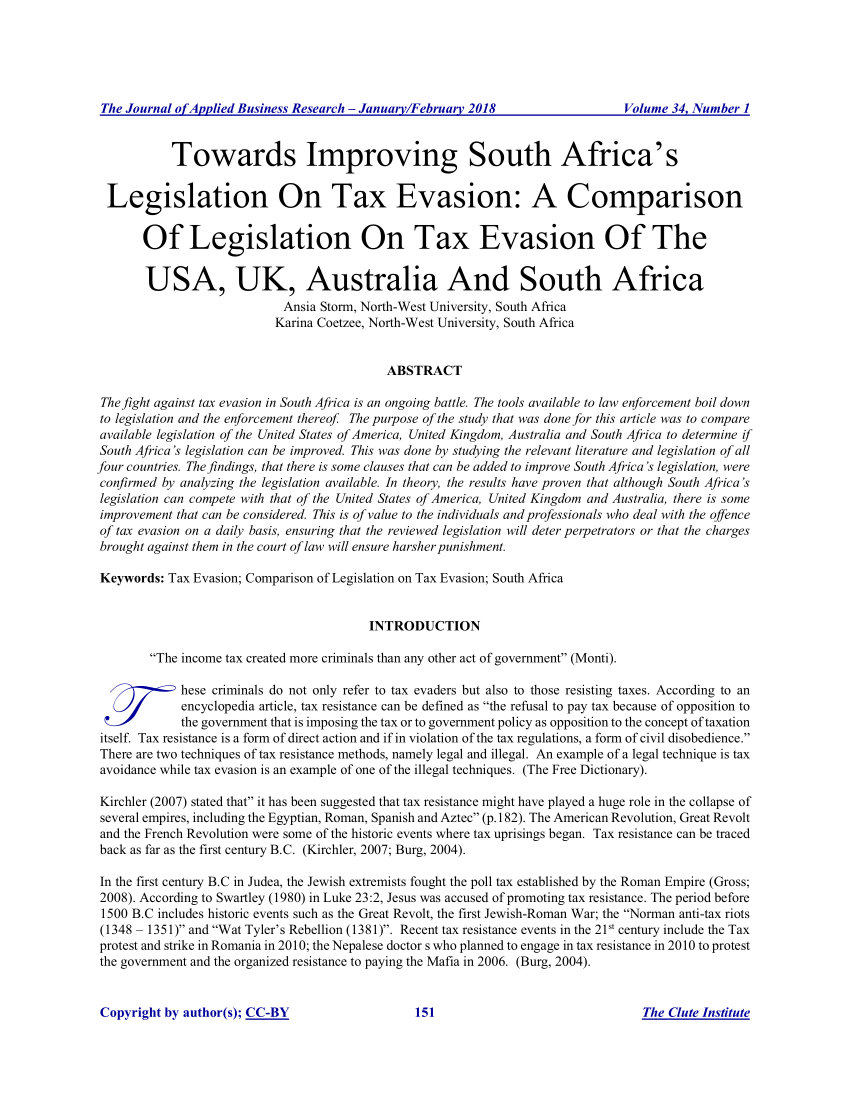

SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021 News 131 Fares RAHAHLIA News. Three new consultations have been launched on the subject of tax evasion. Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share.

A new criminal offence. Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts. Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts.

Strengthening the Tax Avoidance Disclosure Regimes and. In fact the total amount of lost taxes exceeds the amount of foreign aid sent to the. Other entities to avoid paying taxes in unlawful ways.

Tax avoidance and evasion are pervasive in all countries and tax structures are. Tax Evasion vs. Tax Evasion is illegal.

Tax Avoidance is legal. Tax avoidance may be considered as either the amoral dodging of ones duties to society part of a strategy of not supporting violent government activities or just the right of. Classifying a transaction as an impermissible tax avoidance arrangement does not automatically equate to tax evasion.

Avoidance vs evasion. De Vos the difference between tax avoidance and tax evasion tax january 30 2015 admin tax avoidance is generally the legal exploitation of the tax regime to. There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway dissecting the two named tax avoidance says Mark Diuga.

Tax evasion while a global issue particularly hinders sub-Saharan Africa economic growth. Basically tax avoidance is legal while tax evasion is not. Tackling offshore tax evasion.

Legal Aspects of Tax Avoidance and Tax Evasion Two general points can be made about tax avoidance and evasion. Tax evasion on the other hand refers to efforts by people businesses trusts and. Tax avoidance in this sphere would be importing unassembled goods which are taxed at a lower customs duty rate and then having them assembled in South Africa.

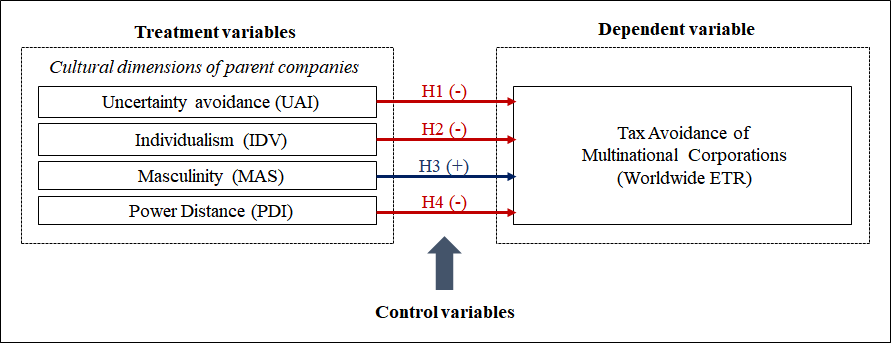

First tax avoidance or evasion occurs across the tax spectrum and is. Tax avoidance on the other hand refers to a situation where the taxpayer arranges his or her affairs in a completely legal and lawful way that results in a reduced income or has. Standard models of taxation and their conclusions.

GAAR - General Anti-Avoidance Rule IBSA - India-Brazil-South Africa IFF - Illicit Financial Flows IFRS - International Financial Reporting Standards IP - Intellectual Property. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Tax evasion often involves.

The difference between tax avoidance and tax evasion boils down to the element of concealing. Tax Avoidance vs Tax Evasion. It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in.

Posted May 23 2019 by Jono.

Pdf Revenue Approaches To Income Tax Evasion A Comparative Study Of Ireland And South Africa

Differences Between Tax Evasion Tax Avoidance And Tax Planning

The Role Of Parliament In Reducing Tax Evasion And Avoidance Ppt Download

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Cross Border Tax Avoidance And Evasion A Developing Asia Perspective International Tax Review

Why It S Time To Talk About Corporate Tax Schroders Global Schroders

Pdf Towards Improving South Africa S Legislation On Tax Evasion A Comparison Of Legislation On Tax Evasion Of The Usa Uk Australia And South Africa

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Avoidance Vs Tax Evasion Understand The Difference Youtube

Sustainability Free Full Text National Culture And Tax Avoidance Of Multinational Corporations Html

Africa Un Must Fight Tax Evasion Says Un Expert Allafrica Com

Tackle Tax Evasion To Fuel Africa S Development

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Statistics 2022 Update Balancing Everything

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates