tax avoidance vs tax evasion hmrc

You can report tax avoidance to HMRC by contacting the HMRC hotline or completing the online reporting form if you. In its most simplistic form there are plenty of people whose financial actions may be labelled as tax avoidance.

Explainer What S The Difference Between Tax Avoidance And Evasion

By contrast avoidance is not illegal.

. How to report tax avoidance. Tax evaders have the intention to deliberately break rules surrounding their tax payments in order to avoid paying the full amount of tax they owe. But lets be fair Tax Avoidance is by definition The arrangement of ones financial affairs to minimize tax liability within the law.

Many tax avoidance schemes devised by accountants and marketed towards the wealthy have been heavily criticised leading to HM Revenue Customs HMRC shutting them down arguing that they amount to tax evasion. Tax evasion is an offence prosecutable by HMRC. This activity is where information is omitted concealed or misrepresented to.

Many tax avoidance schemes that are devised by accountants and marketed towards the rich and wealthy have been heavily criticised and in some cases shut down by HM Revenue Customs HMRC as they argue that these schemes actually amount to tax evasion. The previous Chancellor Dennis Healey famously described the difference between tax avoidance and tax evasion as being the thickness of a prison wall. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Loading Home Buying Calculators How Much House Can I Afford.

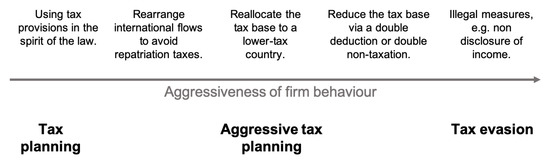

If youve gone a step further and are deemed to be engaging in aggressive tax avoidance that HMRC doesnt agree with you could be investigated and potentially pay the tax back but it is a murky area at times. The major distinction between the two terminologies hinges on the fact that tax evasion occurs when a tax payer does not pay taxes while tax avoidance is the legal reduction of tax liabilities by a tax payer. Tax avoidance means legally reducing your.

Tax evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas tax avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of the country. Tax Avoidance schemes exist because our predecessors took actions to make the tax system fairer ensuring that when certain. HMRC accept that this scheme falls on the accepted tax avoidance side of the line see HMRC website CG64485 Private Residence Relief so long as not undertaken too often as the.

Have been encouraged to get into a tax avoidance scheme. But it is not a criminal offence to have undertaken it. And as best I can tell it remains the case that tax avoidance is not illegal.

Tax avoidance is legal up to the grey area of aggressive tax avoidance. There is a fine line between avoidance and evasion. Tax evasion means concealing income or information from the HMRC and its illegal.

Putting your savings into an ISA for example is one of the more commonplace methods people use to. Where tax avoidance is not necessarily illegal tax evasion always is. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B consists of two reports one.

Heavy Tax Avoidance Offshore corporations and specifically designed tax avoidance schemes would usually fall into this category. Examples of tax evasion are refusal to report or under-reporting the actual income earned to the tax. Tax evasion means doing illegal things to avoid paying taxes.

Unfortunately tax avoidance is often confused with Tax Evasion now that is naughty. In its simplest form many people can practice tax evasion. Tax evasion is when you use illegal practices to avoid paying tax.

Tax evasion on the other hand is when illegal tactics are used to avoid paying taxes such as hiding or misrepresenting income or intentionally underpaying taxes. An Individual Savings Account ISA is a legal way to avoid paying income taxes since all savings in an ISA are tax-free. This may be either a misrepresentation or a concealment of the true state of affairs to tax authorities.

Tax avoidance involves using whatever legal means you choose to reduce your current or future tax liabilities. Tax avoidance means using the legal means available to you to reduce your tax burden. Tax evasion on the other hand is using illegal means to get out.

Tax Evasion vs. Having tax software can help you manage stuff like this legally. Mortgage Calculator Rent vs Buy Closing Costs Calculator.

Its the Al Capone path to financial freedom. There is a fine line between avoidance and evasion. Tax avoidance means exploiting the system to find ways to reduce how much tax you owe.

Its not always easy to see where one ends and the other begins. This could include not reporting all of your income not filing a tax return hiding taxable. In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities.

Famous Tax Evasion Penalties. Definitions and Differences Tax evasion means concealing income or information from tax authorities and its illegal. It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion.

Tax Evasion Understatingconcealing income or overstatingfabricating expenses would be classed as tax evasion. Examples of tax avoidance. The consequences of tax evasion can be serious.

Evasion is a criminal offence it involves deliberately breaking the law and requires some kind of concealment. It is true that avoidance may not be effective in that it may be blocked by anti-avoidance rules or found not to work by a court. Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

James Melville On Twitter We Lose 120 Billion In Tax Avoidance And Tax Evasion That S Enough To Give The Nhs 2 Billion A Week Put That On The Side Of A Bus

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Despite The Tough Talk This Government Is Far Too Soft On Tax Evasion Chris Huhne The Guardian

Hmrc A New Hotline For The Public To Report Fraud And Evasion In The Fight Against Tax Fraud Has Been Launched This Service Will Replace The Two Separate Tax Evasion And

5 Steps To Avoid Facilitating Tax Evasion

Differences Between Tax Evasion Tax Avoidance And Tax Planning

John Wade On Twitter Read It And Weep Social Awareness Graphing

Tax Avoidance Vs Tax Evasion What Is The Difference Cardens Accountants

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

What Is Tax Evasion Definition And Meaning Market Business News

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion What S The Difference

Benefits Fraud Vs Tax Evasion Cost To The British Taxpayer R Labouruk

Tax Avoidance Vs Tax Evasion Understand The Difference Youtube

Hmrc Lost 5 5bn In Tax Evasion Black Hole Over Pre Pandemic Year